We only work with universities that have a strong policy against antisemitism activities among students and faculty.

Enhancing University Revenue

Four Way Approach

Increase Endowment Returns

Unified Educators Partnering With Wells Fargo Advisors Providing New Strategies

Increase Graduate Enrollment

Marketing Existing Programs And Developing New Degree And Certification Programs

Increase Alumni Donations

Recreating Alumni Donation Systems With New Technology

International Student Recruitment

Growing International Student Populations With Content Monitoring

Outsourcing Financial Professionals

At Unified Educators, we specialize in advising and selecting outsourced financial professionals and investment companies for universities looking to invest their endowments. With years of experience and a deep understanding of the higher education sector, we are your trusted partner in seeing your university's investment portfolio is in excellent hands.

Marketing and Recruitment

UE specializes in marketing and recruiting for international students and graduate teacher programs. With years of experience in the education industry, UE has built a strong reputation for providing reliable and efficient services to educational institutions. We are well-versed in the unique needs and requirements of international students, as well as the qualifications and recruitment processes of graduate teacher programs.

Alumni Fund Raising

UE specializes in helping universities increase their alumni donations. We work closely with each university to develop customized UE strategies and campaigns that target potential donors and create a strong connection with their alma mater. We utilizes innovative techniques such as personalized outreach, social media engagement and fundraising events to effectively reach your alumni.

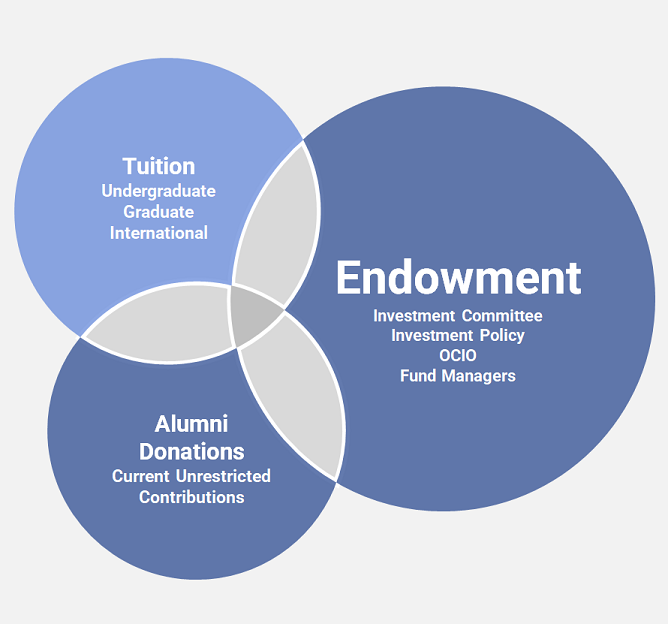

Revenue Model - Three Components Need Integration

Having three main sources of revenue - tuition, alumni donations and liquidity -ensures that the university has a steady and reliable source of income. This means that if one revenue source experiences a decline in any year, financial support for the institution will be maintained.

Strategic, Responsible, and Diligent

What We Do

Endowment Investing and Fund Consulting

We understand the unique needs and goals of universities when it comes to managing their endowments. With our expertise and industry knowledge, we can help you navigate the complex financial landscape and select the right professionals and companies to help your university achieve its long-term financial objectives.

We conduct thorough research and analysis to understand your university's financial goals and risk tolerance. Based on our findings, we provide personalized recommendations for the best outsourced financial professionals and investment companies for your university's specific needs.

Our team consists of experienced financial professionals who have extensive knowledge of the investment industry and its trends. We have a proven track record of successfully advising and selecting outsourced financial professionals and investment companies for universities of all sizes.

Why Choose Us

A Moral and Ethical Approach to University Investments and Student Safety

At our company, we believe that every student deserves to learn in a safe and welcoming environment. That’s why we work exclusively with schools that are committed to providing a campus free from hate speech and discriminatory actions, such as antisemitism, islamicphobia and anti-immigrant attiitudes.We understand the importance of creating a positive and inclusive school culture, and we are dedicated to helping schools achieve this goal.

30+

Years Experience

Manhattan College in Bronx, NY expands its financial consulting services with Unified Educators

Unified Educators renews its contract with Manhattan College, expanding services to include Rosemont plus investment consulting and counseling, strengthening their longstanding partnership and financial stability.

Unified Educators produces 20 million for Rowan University

Unified Educators successfully generated $20 million in revenue for Rowan University through innovative marketing and strategic student recruitment, significantly boosting the university's enrollment, financial standing, and educational impact.

Rosemont College renews its contract with Unified Educators

Unified Educators has renewed its contract with Rosemont College, expanding its comprehensive marketing and student recruitment services to further promote the college's mission and enhance its enrollment efforts.

Cambridge College benefits from increase enrollment due to Unified Educators

Cambridge College in Massachusetts has experienced a significant 20% increase in graduate enrollment due to its successful partnership with Unified Educators Consulting Company, which has enhanced the college's program offerings and attracted a more diverse student body.

Get in Touch

Outsourcing Fund Managers

Book Your Consultation Today and Take the First Step Towards Success